The next generation of financial services ecosystems in Saudi Arabia

The Kingdom of Saudi Arabia is one of the fastest-growing economies in the world. The transformation of the country’s financial services sector is the motor driving growth across non-oil sectors, which is one of the main goals of Saudi’s Vision 2030.

The economic boom the country is witnessing does not mean that service quality is also improving. Building and maintaining customer trust is still an undeniable challenge as most banking and finance services are changing in shape, and regulators play an important role in shaping policy.

As a consequence of the ongoing transformation and the changes across the board - starting with the very structure of the financial firms all the way to how they talk to their customers - regulators are enforcing new frameworks that govern the processes and protect the customers’ interests. This, in turn, highlights the challenges of providing the convenience and transparency that are expected by modern customers.

Customer expectations are changing at hypervelocity

Historically, one of the main concerns over banks has been, "Is my money safe?" For most people, this concern was superseded by other worries during the past decade. But now, as we witness the emergence of new ways of banking, the same old concerns resurfaced, accompanied by a few more.

Not only do modern consumers expect faster payment processing times, lower costs, and greater transparency, they are increasingly judging their financial institutions on such qualities as ease of engagement, responsiveness, and accessibility.

“Companies that effectively organize and manage customer experience can realize a 20% improvement in customer satisfaction, a 15% increase in sales conversion, a 30% lower cost-to-serve, and a 30% increase in employee engagement,” McKinsey finds. This is why more than 70% of senior banking executives rank CX as a top priority, according to the Digital Banking Report.

Technology is changing the game

Unfortunately for banks and finance firms, the epidemic no longer justifies providing subpar customer service. Today’s customer knows the potential of combining data, advanced insights, improved technology, and omnichannel communication. Today, customer service acts as a differentiator and a growth engine.

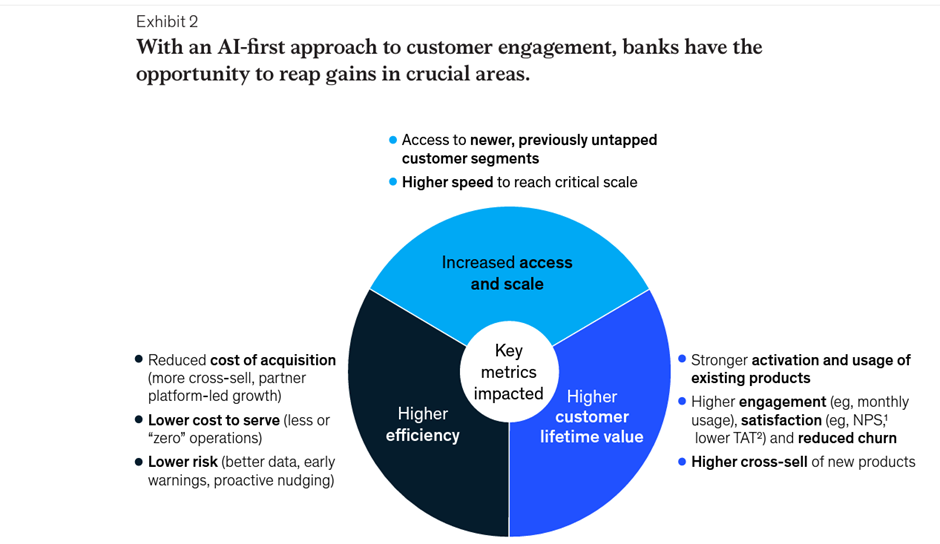

Moreover, the emergence of Artificial intelligence (AI) is transforming the way banks and financial firms engage with their customers. AI-powered chatbots can answer customer questions 24/7, while AI-powered analytics can help banks to personalize their products and services. AI is also being used to automate tasks, such as fraud detection and risk assessment.

Source: Reimagining customer engagement for the AI bank of the future by Mckinsey.

As Saudi embraces a positive attitude towards innovative technologies in FinServ, it gives the most attention to delivering digital-first and customer-focused banking. The Central Bank is pushing for digitalization by supporting open banking, digital banks and the fintech sector.

For these digital brands to deliver on the current customer expectations while navigating emerging challenges, businesses need to leverage technologies that are:

- optimized for their unique requirements and complexities

- simple to integrate and implement

- intuitive to allow easier and more natural customer experiences

In conclusion, intelligent omnichannel engagement is essential for the banking and finance sector to achieve growth. By providing customers with a seamless and consistent experience across all channels, banks and financial institutions can build customer loyalty and boost sales. In addition, omnichannel engagement can help banks and financial institutions to improve customer satisfaction and reduce churn.